Navigating ever-changing tax laws – and reducing your business’ state and local tax liability – requires in-depth knowledge of state and federal tax laws. The State and Local Taxation (SALT) team at Dentons has deep experience in every aspect of highly technical business taxation matters – property, sales, income, franchise, gross receipts, and occupational/business license taxes; tobacco, motor fuel, and other excise taxes; telecommunications taxes; and state, county, and local taxes and tax policy.

Our clients benefit from the knowledge and experience of our team, which includes seasoned tax litigators, former government trial counsel, CPAs, law school professors on tax, and former in-house lawyers. Our tax lawyers have been recognized by leading legal publications, including Chambers USA, International Tax Review, The Best Lawyers in America, and the Legal 500.

Clients trust the Dentons Tax team to manage challenging and complex tax issues, including audit representation, litigation and appeals, structural and transactional planning, and transactional due diligence. Our Tax lawyers have handled high-profile tax cases and are known nationally as thought leaders on trends shaping the tax landscape. Many of our Tax lawyers are sought-after speakers at national industry events such as the Council on State Taxation (COST) and the Institute for Professionals in Taxation (IPT) annual conferences and as expert sources in publications such as Bloomberg, Law 360, Tax Notes and The Tax Lawyer.

Our team has experience with every component of business taxation, including:

- Sales and use taxes

- Property taxes

- Tax-exempt status of entities, parcels and products

- Corporate income and franchise taxes

- Unitary and apportionment planning

- High-net-worth individual and entertainer tax issues, including residency audits

- Tobacco, motor fuel, motor vehicles, alcohol, and other excise taxes

- Employment taxes

- Telecommunications taxes

- Occupational/business license taxes and other local taxes

- Unclaimed property

As the world’s largest global law firm, Dentons has the unparalleled ability to access a platform of more than 6,000 lawyers in 180+ offices across more than 80 countries to provide uniquely global and deeply local legal solutions. This deep bench gives us an unsurpassed ability to navigate the specific challenges of presenting complex tax disputes to administrative and judicial tax tribunals and appellate courts – and winning.

Our Tax team successfully handles the spectrum of state and local actions across the nation, including audits, protests, state tax tribunals, state lower courts, and appeals to the state appellate courts and federal courts (including the Supreme Court of the United States). We bring a wealth of experience resolving cases in settlement and practicing before these courts representing clients in state and local tax disputes.

Whether you are a corporate entity, partnership or individual client, Dentons is committed to helping you navigate the complexities of state and local tax.

Our experience:

- Ventas, Inc.: Representing healthcare real estate capital provider Ventas, Inc. against the Louisville Metro Revenue Commission involving a request for alternative apportionment in Jefferson Circuit Court. This complex tax matter involved constitutional tax principles contained in the Commerce Clause of the U.S. Constitution. (Ventas, Inc. v. Louisville/Jefferson Cnty. Metro Rev. Comm’n, No. 19-CI-000899 (Jefferson Cir. Ct. 2021), aff’d, No. 2021-CA-0235, 2022 WL 414008 (Ky. Ct. App. Feb. 11, 2022) (holding sovereign immunity did not prevent taxpayer’s alternative apportionment challenge), and No. 19-CI-000899 (Jefferson Cir. Ct. Oct. 25, 2023).

- Delta Air Lines, Inc.: Represented international and domestic airline before the Utah Supreme Court involving a challenge by Salt Lake County – the County in which all of Delta’s Utah property value is located – to the constitutionality of a 2017 Utah statute that requires the Utah State Tax Commission to use a preferred valuation methodology to assess airline property. Depending on the outcome of the County’s appeal and the fluctuating assessment of Delta’s property each year, the difference in assessed value between the 2017 statute and the County’s preferred valuation methodology, could be several million dollars in taxes each year.

- Lafarge North America: Represented as lead counsel the international manufacturing conglomerate taxpayer in successfully challenging sales and consumer use tax assessment on manufacturing supplies. (Lafarge N. Am., Inc. v. Testa, 104 N.E.3d 739 (Ohio 2018).

- Carriage Ford, Inc.: Representing as lead counsel the automotive dealership regarding a refund of Kentucky motor vehicle usage tax. The trial court held that Carriage Ford was entitled to a refund of $183,000 (sales tax paid to Indiana) and the Kentucky Court of Appeals affirmed on July 14, ruling Carriage Ford proved it paid the Indiana sales tax and should be entitled to a credit from Kentucky. (Dep’t of Rev. v. Carriage Ford, Inc., No. 2022-CA-0231, 2023 Ky. App. LEXIS 52 (Ky. Ct. App. July 14, 2023).

- High-net-worth-individuals: Representing certain high-net-worth individuals on various audit and residency issues in various states

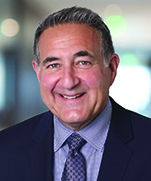

State and Local Tax Team

Recent Posts